S&P Global Ratings

What’s Happening

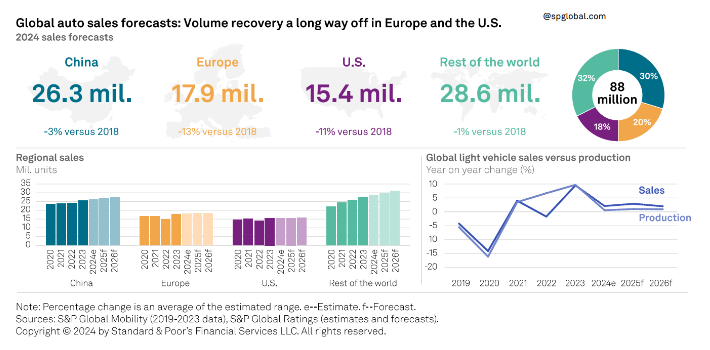

- We maintain our expectation of modest LV demand growth, in the 1% to 3% range, over 2024-2026. Following consistent inventory rebuilding over 2023, we expect global production to be strictly demand driven, which leads us to anticipate very modest growth of 0% to 1%.

- The report discusses global auto sales forecasts, particularly the slower growth of electric vehicles (EVs), which offers temporary relief to legacy automakers. The forecast indicates that automakers in the U.S. will take a more measured approach to EV volume build-out due to slower demand and to avoid price wars, which led us to revise down our 2025 forecast for EV’s U.S. market share to about 15%, from 18%. EV sales growth rates remain solid across Europe, China, and the U.S. in early 2024, though slower compared to the spike over 2020-2021.

- Global Auto Sales Forecasts

- China– We believe China is unlikely to maintain the high-single-digit growth of Q1 as consumer sentiment remains soft due to the negative wealth effect of the prolonged property-market stress. This prompted us to revise our 2024 LV sales growth forecast for China to 2% to 4%, up from 0% to 2%, followed by more moderate growth in 2025 and 2026.

- Europe– Europe’s 7% growth over Q1 2024 was driven by strong passenger car sales in Russia, Turkey, and Western Europe– where the 5 largest markets (Germany, France, Italy, Spain, and UK) posted an average increase of 6.8%. We believe Western Europe’s result is the tail of order books cumulated during 2023.

- US– Like Europe, U.S. auto sales growth in Q1 was driven by inventory building and higher incentives in some segments. Softer sales growth in March (which equated to an annual sales rate of 15.5 million units) is consistent with our forecasts, which incorporate a delayed impact on consumer purchasing power from the contiguous macroeconomic shocks of high vehicle prices, ongoing inflation, and higher interest rates for longer.

Why It Matters

- The slower growth of EVs provides temporary relief to legacy automakers as it supports a more profitable product mix.

- It also indicates an industrywide adjustment that aligns with a more cautious approach to EV production in the U.S.

- The forecast highlights the importance of adapting to market conditions and avoiding excessive production that could lead to price wars and lower profitability.

- EV pricing dynamics, the margin dilutive effect of electric powertrains for most of legacy OEMs, and the market distortive profile of subsidies could weigh on motivation to push EV sales. That will likely lead to stable (at best) or declining EV market share in the U.S. and Europe. Conversely, in China, we believe that pricing parity and the large range of models at every price segment will continue to pressure sales of traditional powertrains and support increasing EV adoption.

- Germany’s EV adoption rate reflects Europe’s short-term EV fatigue.

Looking Ahead

- Pricing Pressure Is Intensifying– we expect a weaker pricing environment in 2024 and 2025, compared to 2023.

- We expect average new vehicle prices will fall about 10% from 2023 levels over the next 18-24 months as demand shifts to used vehicles from new vehicles. We expect used-vehicle prices to fall another 5% to 7% in 2024 (after falling about 7% in 2023) as increasingly difficult financing conditions weigh on demand while supply increases.

- China– Slightly stronger momentum in production growth reflects China’s increasing LV exports. Chinese original equipment makers (OEMs), including BYD Auto Co., Ltd. and SAIC Motor Corp., Ltd. are heavily investing in vehicle carrier vessels and renting logistic space in destination harbors to support their accelerated overseas expansion.

- Europe– Despite the solid start to 2024, we expect annual sales will moderate, notably as high labor costs limit disinflation and likely temper the pace of much awaited interest rate cuts by the European Central Bank (ECB). European Commission elections, the risk of escalating conflicts in Eastern Europe and the Middle East, and legitimate expectation of lower interest rates and prices (especially in the volume segment) could delay big ticket purchases. This leads us to maintain moderate expectations of LV sales growth, at 0% to 2% over 2024-2026, following the 19% increase of 2023. European production could suffer from increasing imports and automakers efforts to reduce fixed costs by cutting their production footprint.

- US– Despite a recent upward revision of U.S. GDP to 2.5%, from 1.8%, we maintain our view of that sales in the U.S. will be roughly in line with the 15.6 million achieved in 2023 (+12% year on year) and rebound slightly in 2025 and 2026, but remain below pre-pandemic levels of 16.9 million. We expect significant launches of EVs at more affordable price points in the coming years, supported by manufacturer subsidies, investment in local supply chains, and tax credits. These factors are likely to help reduce the U.S.’s EV market share gap with Europe and China beyond 2025.

Bottom Line

- Publicidad-

- Global light vehicle sales will increase by 2% to 3% over 2024 and 2025 (to over 90 million), mainly supported by growth in Southeast Asia and India.

- U.S. and Europe may lag global growth, while China’s long-term potential remains.

- The industry should exercise discipline while rebuilding capacity toward inventory levels of 50-60 days, which remains about 30% below pre-pandemic levels. This should reduce pressure on automakers to increase incentives and lower prices, helping to protect margins, even if consumer demand weakens over the next 18 months.

- Electric Vehicles

- Slower EV sales should support legacy automakers’ near-term profits, but electrification remains a challenge, particularly given China’s supply chain advantages.

- Large-scale price competition started last year and has become more aggressive and frequent this year as producers are eager to expand volume amid falling battery prices. For loss-making EV makers, scale and economies of scale are key to profits. With fast electrification and EVs reaching price parity with gasoline vehicles, the market size for ICE vehicles is gradually shrinking while production capacity remains sizeable. This led to ICE vehicle price cuts by traditional OEMs that are struggling to protect market share and survive. This also explains why exports have become increasingly important for Chinese OEMs.

- China– EV sales momentum in China remains solid, but the competitive environment is fierce.

- Europe– We remain confident that EVs will continue to gain market share in Europe.

- US– Weaker U.S. emission reduction targets have prompted a downward revision of our EV market share forecasts.

Source:S&P Global Ratings